10 Things You Don’t Want In Life

Hey everyone, today, I have a special guest post from my good friend Piffany.

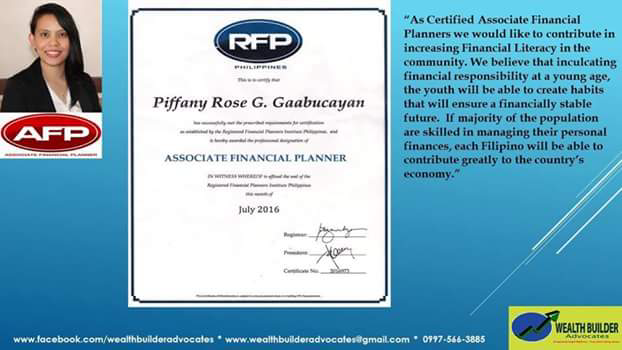

Piffany is a Personal Finance advocate, member of Wealth Builder Advocates Club Inc., a licensed Associate Financial Planner, and a Financial Adviser from Pru Life UK. Piffany is currently residing in The Philippines.

I’ll let her take it from here:

Have you ever asked yourself? “What do I really want out of my life?” Well, yeah, I have. And it took me around 10 years to figure that out. HAHAHA Please don’t wait for 10 years. Trust me. It was a marvelous journey but the journey never stops. We will always encounter changes along the way but among those changes we have to figure out to the core, what is it, that we really want.

I wasn’t cut out for the superficial things in life. I’ve been questioning myself constantly, praying real hard, thinking endlessly and ended up paralyzed. (just kidding)

So “where do we start”?

That is the ultimate mind boggling question that haunts us every now and then. So I thought, hey there must be another way around this.

I figured, I have to identify first what I really DON’T want before I can pinpoint WHAT I WANT.

As a Financial Planner, I am in the business of helping people enrich their lives and make the most out of it. In lieu with Personal Finance, Here are the 10 things that you DON’T want in life:

1. You DON’T want to be a burden/liability to your family (if you’re married) or your future family (if you’re still single).

Who wants to be a burden anyway?

Well, yeah, you will be, if you don’t prepare ahead.

You will be: once you’re sick, once you’re no longer productive, once you’re not giving your share as a RESPONSIBLE family member.

Don’t get me wrong here, we humans are sentimental.

You shouldn’t consider that as a burden etc.etc.etc. Family is Family.

Yes you’re right but the truth hurts.

It doesn’t have to be that way if you’re responsible enough to prepare for emergencies/contingencies along the way.

We aren’t immortals, we will get sick eventually, we will grow old, and we will die. As to when will it happen; it is uncertain.

BUT what is certain is that we can always hope for the best and PREPARE for the worst.

2. You DON’T want to stay unaware of your spending habits.

It is sad that most people are unaware of their spending habits.

Well, yes it helps the country because it fuels the economy but then again it doesn’t elevate you to a better life.

It will take a while to educate and cultivate a different mindset to create change in the long run.

It is not your fault if the system is broken, if financial literacy is not taught in schools, BUT it is your fault if you stay as is.

I mean, most of us keep complaining that: my salary is not enough, taxes are enormous, the government is not supportive enough.

But what can we do? Can we change the system in just a flick of a magic wand? Will our lives improve instantly if we change the government?

My Dear, change has to start within YOU.

What lies in your programming will stay the same unless you start taking an inventory of your good and bad habits, particularly your spending habits.

How your way of life looks like will always be a reflection of how you manage your finances in the first place.

3. You DON’T want to be close-minded towards opportunities of learning that will help you manage your finances.

In the Information Age, Ignorance is a choice.

We are surrounded with tons of information everywhere and if we put that useful information to use, we will definitely benefit from it.

Learning is a skill. Cultivate that mind to wake up and seek help from different sources: books, audio books, seminars, training programs, financial consultants, etc. From there, you can navigate your way towards your desired destination.

4. You DON’T want to stay broke or Just-Over-Broke.

It all starts with your Mindset. If you want to dig in; how to re-program your mind to achieve the kind of life you’ve always wanted, check out: T. Harv Eker’s book : Secrets of the Millionaire Mind.

5. You DON’T want to wait until tomorrow, next week, next month, next year to actually start saving and eventually start investing as well.

The more you delay. The more you lose. Why? Because you can get more money but you cannot get more time. Your money will lose the opportunity for growth day after day if you keep on procrastinating. Follow a system.

Every pay day, make sure you set aside and label it for: Necessities, Financial Freedom, Long Term Savings, Education, Play, and Give.

Source: Secrets of the Millionaire Mind

6. You DON’T want to wait until you’re sick or no longer insurable to get healthcare or life insurance.

It is ironic that you get insurance for your CAR, but you tend to forget buying insurance for YOURSELF? How smart is that? Anyways.

7. You DON’T want to wait until you can no longer afford to buy insurance or you’re too old to buy one when you need it.

Not everyone can be given the privilege to avail protection for emergencies.

So don’t think that Financial Consultants/Healthcare agents are just after your money.

They are after your welfare. You have every right to choose the right person to trust. Think twice,the next time someone presents a financial solution for your future needs.

“You cannot buy life insurance when you’re already dead. You cannot buy health care when you’re already sick. You cannot buy investments when you’re already retired. Because you can only buy financial products while you don’t need them.”

8. You DON’T want your accumulated wealth to be eaten up by Estate Taxes because you haven’t purchased enough protection for it. You can’t just accumulate wealth and not protect it for proper succession.

Did you know that your right to transfer assets will be taxed after you die?

There’s no way around it. You die and your heirs have to pay estate tax before any of your assets get to be transferred to their names. So, how would they pay it then? In cold CASH.

What if they don’t have CASH? then just leave it to the tax bureau. Bye-Bye.

That’s why I’m a believer of INSURANCE. It saves your family from all the trouble. It will be your Knight in Shining Armour. Most people don’t realize that because they never take the time to listen to Financial Consultants.

Most people haven’t got their heads around it because they are too close minded of something that can actually save them in the future.

9. You don’t want to work for money BUT rather the other way around.

How do you actually do that? Simply by INVESTING. Whatever you earn from “working for money” INVEST it, so that it can grow further. In that way you make “money work for you”.

So where should you invest? There are many options to choose from. Either put up a business, buy rental property, or invest in paper assets : stocks, bonds, mutual funds, or a practical vehicle like VUL (insurance+mutual funds).

The HOW is easy if your WHY is strong enough. If you don’t want the hassle of it and you want an investment vehicle with an expert fund manager managing it for you and share the idea of investing to your family, friends, and co-workers as well. I can help you. Feel free to contact me at anytime.

10. You DON’T just want to live a comfortable life BUT you want to be a blessing to others with your wealth as well.

There’s so much to life than just living it for ourselves. We are just stewards of God’s wealth on this planet. It is meant to be shared to others.

If you’ve reached that point in life wherein you just want to give not just to your family but extend it to those who are in need; you’ve reached a different level of “High”. You are filled with so much love and blessings that you can’t help but overflow.

So, have you figured it out by now, what you WANT in life? Cheers! 😉

If you would like learn more about Budgeting, Saving, Building an Emergency Fund, Buying Insurance, Stock Market Investing etc. I am willing to share more info that will provide great value to jump start your financial goals.

I firmly believe that Proper Financial Planning is the KEY to Financial Freedom. I’m glad to be of service and please feel free to ask questions: piffany_rose87 (at) yahoo (dot) com

If you would like daily finance tips: You can follow Piffany at her very active Facebook Group: Personal Finance Enthusiasts.